45 yield to maturity coupon bond

US 10 year yield : r/bonds - reddit.com For example, buying a 10 year, You'll earn a steady yield at 3.8% for 10 years, at the end of the 10 years you will get your full investment back, short term price fluctuations don't matter in the long term for bonds. This rotation would make sense if you think over the long term equities are going to return less than the bond yield per year. ICE BofA US High Yield Index Effective Yield (BAMLH0A0HYM2EY) Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ...

What Is A Bond? - Bonds Online Yield to Maturity A bondholder can hold onto the certificate until maturity, or they can sell it in the open market, where the price other investors pay for it can vary, depending on how close the bond is to maturity. Typically, the farther away from maturity the bond is, the lower its price and vice versa. Market Interest Rates

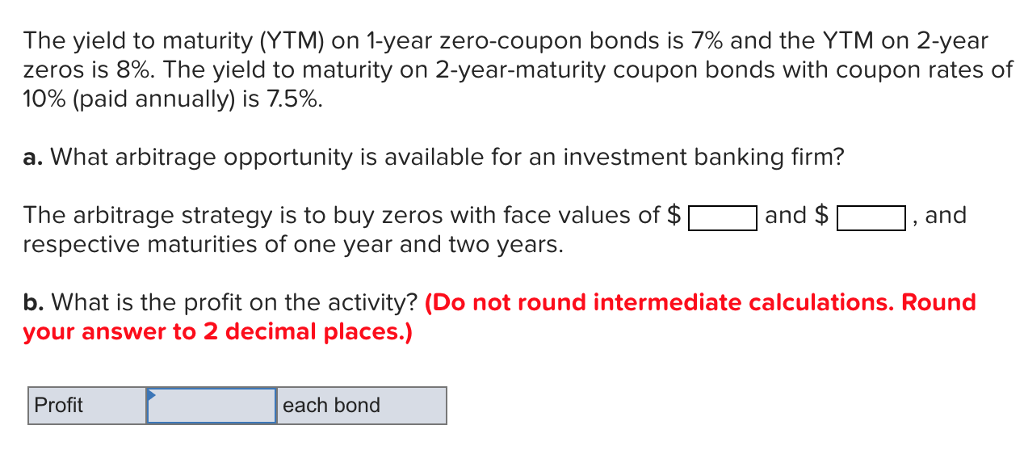

Yield to maturity coupon bond

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Macaulay Duration - Investopedia A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In... Bond Yield Calculator - CalculateStuff.com How to Calculate Yield to Maturity. Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating ...

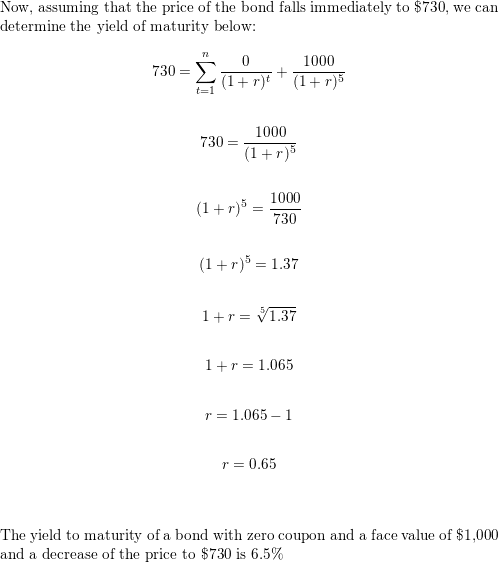

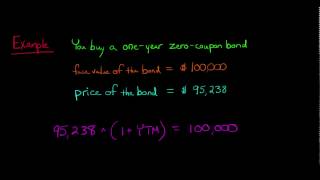

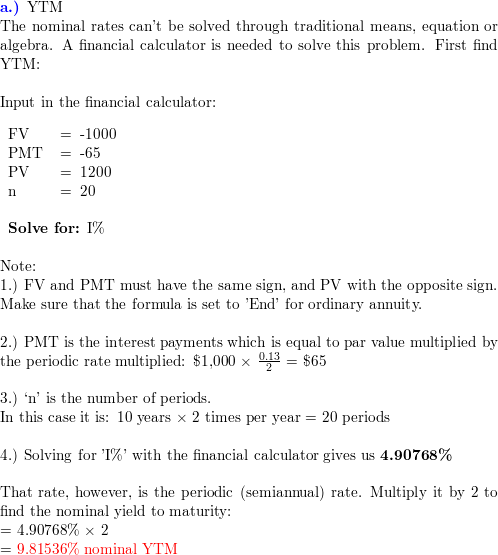

Yield to maturity coupon bond. Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. Five inputs are needed to use the "Rate" function; time left ... Some bonds on secondary market are essentially "Zero-Coupon" bonds With yields rising, many older bonds are selling at a discount but their coupon can be relatively low (e.g 0.9%). With the discounted purchase price the YTW can be much higher (e.g. 3.8%). But the YTW takes into account the fact that you purchased the bond at a cost of less than $1000, and when it's redeemed you will receive $1000. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.083% yield. 10 Years vs 2 Years bond spread is -20.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Yield to Maturity (YTM) Definition & Example | InvestingAnswers 10/03/2021 · Also referred to as book yield and redemption yield, yield to maturity (YTM) is the total return that’s anticipated on a bond or other fixed-price security. The YTM is based on the assumption that the investor will purchase a bond and hold it until maturity. It also assumes that all coupon payments are reinvested during the same period at the same rate.

2 Year Treasury Note Rate Constant Maturity - Bankrate Two-Year Treasury Constant Maturity What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to the equivalent of a... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... XB - BondBloxx® ETF Yield to Maturity: The discount rate that equates the present value of a bond's cash flows with its market price (including accrued interest). The Fund Average Yield to Maturity is the weighted average of the fund's individual bond holding yields based on Net Asset Value ('NAV'). The measure does not include fees and expenses. Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

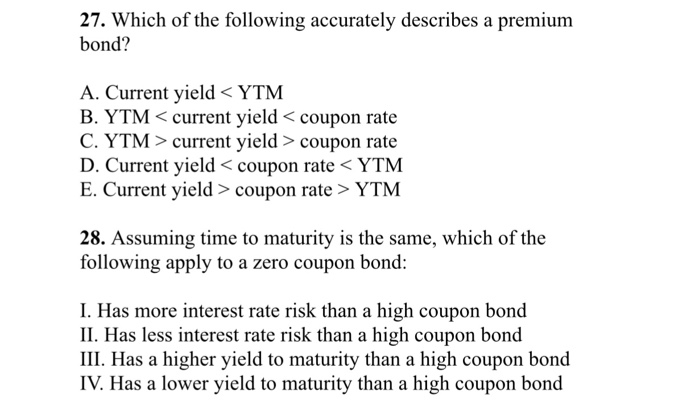

iShares® iBonds® Dec 2027 Term Corporate ETF | IBDS 30 Day SEC Yield as of Sep 29, 2022 5.00% 12m Trailing Yield as of Sep 28, 2022 2.58% Standard Deviation (3y) as of Aug 31, 2022 7.60% Average Yield to Maturity as of Sep 29, 2022 5.44% Weighted Avg Coupon as of Sep 29, 2022 3.38 Weighted Avg Maturity as of Sep 29, 2022 4.61 yrs Effective Duration as of Sep 29, 2022 4.13 yrs Comparison of Bonds - Yield to Maturity - BrainMass A quick look at bond quotes will tell you that GMAC has many different issues of bonds oustanding. Suppose the four of them have identical coupon rates of 7.25% but mature on four different dates. One matures in 2 years, one in 5 years, one in 10 years, and the last in 20 years. Assume that they all made coupon payments yesterday. a. WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of... en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia fluctuations in the market price of a bond prior to maturity. Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon ...

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Average Duration Definition Bonds - Risi Stone Inc. If each bond has the same yield at maturity, this is the weighted average of the bond`s maturities in the portfolio, with the weighting proportional to the bond prices. ... For example, if interest rates were to rise by 2%, a 10-year government bond with a coupon of 3.5% and a maturity of 8.4 years would lose 15% of its value. Using the numbers ...

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date.

Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia This yield is determined by taking the bond's annual interest and dividing that amount by its current market price. To make this clear, consider this simple example: a $1,000 bond that sells for...

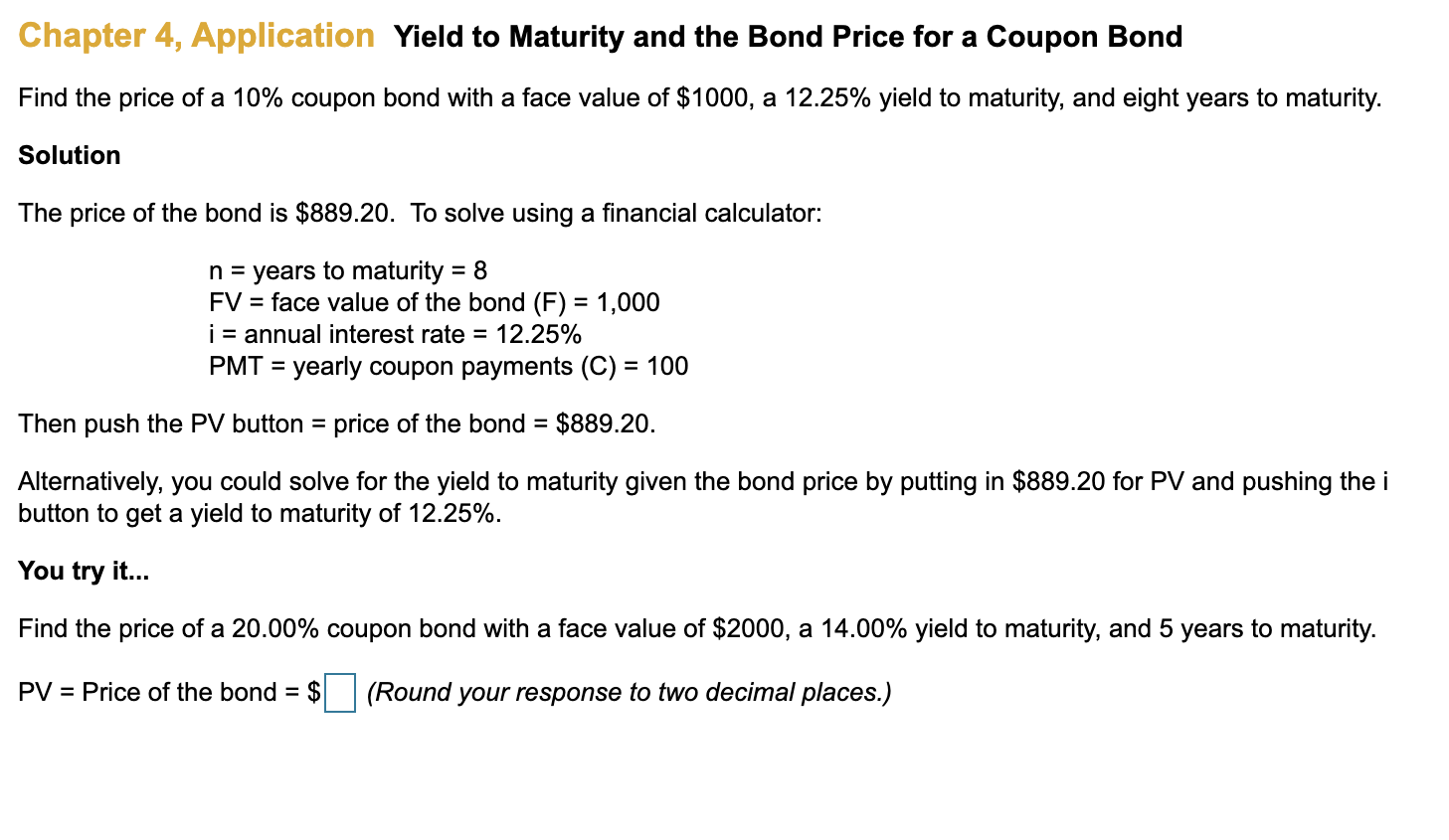

Yield to Maturity Calculator | YTM | InvestingAnswers To calculate a bond's yield to maturity, enter the: bond's face value (also known as "par value") coupon rate; number of years to maturity; frequency of payments, and ; current price of the bond. How to Calculate Yield to Maturity. For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

all else constant, a bond will sell at _____ when the yield to maturity ... FA bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond price. YTM assumes that all coupon payments are reinvested at a yield equal to the YTM and that the bond is held to maturity.

Bond Basics: The Ins & Outs of the Bond Market Part 3— Risks and ... The bond's value will decrease to match the equivalent coupon yield of the new interest rates. In the example above, if equivalent bond coupon rates rise to $80 or 8%, the bond's value would drop to $920.15 if the Yield to Maturity (YTM) was five years. Bonds with longer Maturities are more sensitive to interest rates, the example above ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06/05/2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date.

XCCC - BondBloxx® ETF Yield to Maturity: The discount rate that equates the present value of a bond's cash flows with its market price (including accrued interest). The Fund Average Yield to Maturity is the weighted average of the fund's individual bond holding yields based on Net Asset Value ('NAV'). The measure does not include fees and expenses.

How To Invest In Bonds - Forbes Advisor UK To calculate the current yield, divide the annual coupon of £3.75 by the current bond price of £105. This means that the current yield would be 3.57%, which is lower than the 'nominal yield ...

MICROSOFT CORP.DL-NOTES 2017(17/57) Bond - Insider The Microsoft Corp.-Bond has a maturity date of 2/6/2057 and offers a coupon of 4.5000%. The payment of the coupon will take place 2.0 times per biannual on the 06.08.. At the current price of 94 ...

iShares® iBonds® Dec 2029 Term Corporate ETF | IBDU - BlackRock Average Yield to Maturity as of Sep 19, 2022 5.12% Weighted Avg Coupon as of Sep 19, 2022 3.70 Weighted Avg Maturity as of Sep 19, 2022 6.66 yrs Effective Duration as of Sep 19, 2022 5.71 yrs Convexity as of Sep 19, 2022 0.36 Option Adjusted Spread as of Sep 19, 2022 144.56 bps

Another milestone: The yield advantage for EE Savings Bonds has ... If you've already held the EE Bond five or more years, you may want to keep it until maturity. Here is how that math works out, ignoring the 0.1% fixed rate, which becomes irrelevant when the bond doubles: After 5 years, the EE Bond would double in 15 years, creating an effective annual return of about 4.8% for the final 15 years..

investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · Is Yield to Maturity the Same as Coupon Rate? The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn’t ...

› financial › bond-yieldBond Yield Calculator - CalculateStuff.com How to Calculate Yield to Maturity. Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity.

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 2.091% yield. 10 Years vs 2 Years bond spread is 34.8 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in September 2022). The Germany credit rating is AAA, according to Standard & Poor's agency.

Determine Coupon Rate, Current Yield, and Yield to Maturity - BrainMass Given the par value, annual interest payment, market price, and maturity date of a bond outstanding, this solution illustrates how to determine (a) the coupon rate, (b) the current yield, and (c) the approximate yield to maturity. $2.49 Add Solution to Cart ADVERTISEMENT

› coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40.

Solved Kellwood Co. bonds have 7% coupon rate, 6% yield to | Chegg.com Kellwood Co. bonds have 7% coupon rate, 6% yield to maturity, and will mature on January 31st, 2025. The semi-annual coupon payments are scheduled on January 31st and July 31st of each year. Today is September 30th, 2022. 1) What is the flat price of the bond? (t: number of coupon payments to collect before expiration date?

Current yield - Wikipedia The current yield, interest yield, income yield, flat yield, market yield, mark to market yield or running yield is a financial term used in reference to bonds and other fixed-interest securities such as gilts.It is the ratio of the annual interest payment and the bond's price: =. According to Investopedia, the clean market price of the bond should be the denominator in this calculation.

How To Buy Bonds This strategy offers stability, whereas the yield on a bond mutual fund or fixed-income exchange traded fund (ETF) ... coupon and maturity date of the bonds you want to purchase. You can find the ...

Erste Group senior bonds - produkte.erstegroup.com A special form is the zero coupon bond. At the end of term bonds are redeemed at 100 % of nominal value. Below you find our product range. Tutorial. Select your Criteria. Type of Coupon. Latest Coupon. Maturity. Yield to maturity p.a. Products marked with this icon are no longer publicly offered. The product-specific content published here is ...

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, …

How To Buy Treasury Bonds And Buying Strategies To Consider The bond needs to value to make its yield to maturity more enticing. If the buyer at ~$97.20 holds onto the bond until it is redeemed on 06/30/2023, they will receive $100 for each bond they own, receiving an effective yield of ~4.13%. The online brokerage calculates this all for you.

Yield to Call Calculator | Calculating YTC | InvestingAnswers Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to call "2" as the coupon payments per year

Bond Yield Calculator - CalculateStuff.com How to Calculate Yield to Maturity. Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating ...

Macaulay Duration - Investopedia A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

:max_bytes(150000):strip_icc()/YTM-356ce239fec6426696be4b7e3c58c5aa.jpg)

Post a Comment for "45 yield to maturity coupon bond"