41 coupon paying bond formula

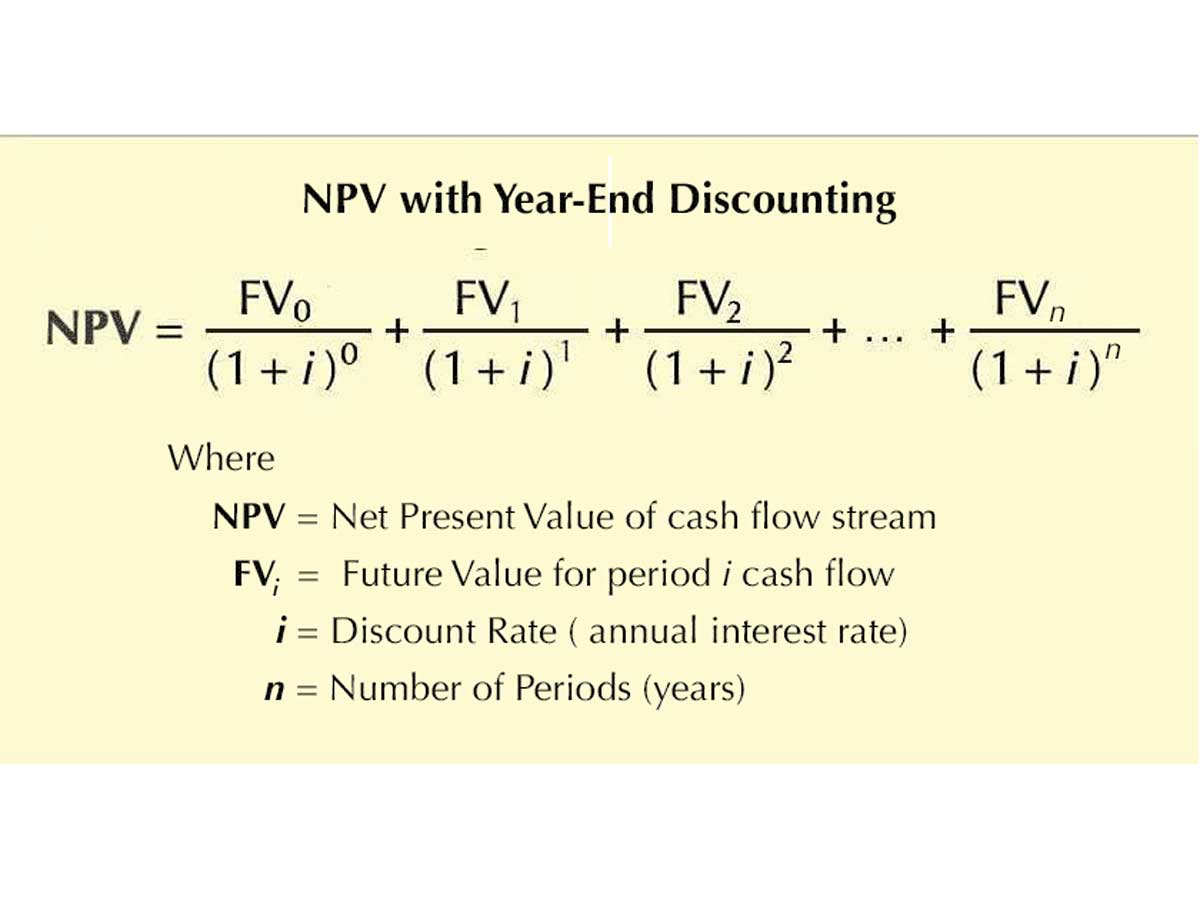

Money: Personal finance news, advice & information - The ... Nov 15, 2022 · Chronic childcare shortage leaves thousands of parents ‘paying to work’ By Rachel Mortimer 15 Nov 2022, 7:00am. Advertisement. ... Record-high annuity rates drop as bond markets calm Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Annual Coupon Payment = 5% * $1,000 Annual Coupon Payment = $50 The other cash flow to be received at the end of three years in the form of par value is $1,000. YTM is calculated using the formula given below Bond Price = ∑ [Cash flowt / (1+YTM)t] $1,050 = $50 / (1 + YTM) 1 + $50 / (1 + YTM) 2 + ($50 + $1,050) / (1 + YTM) 3

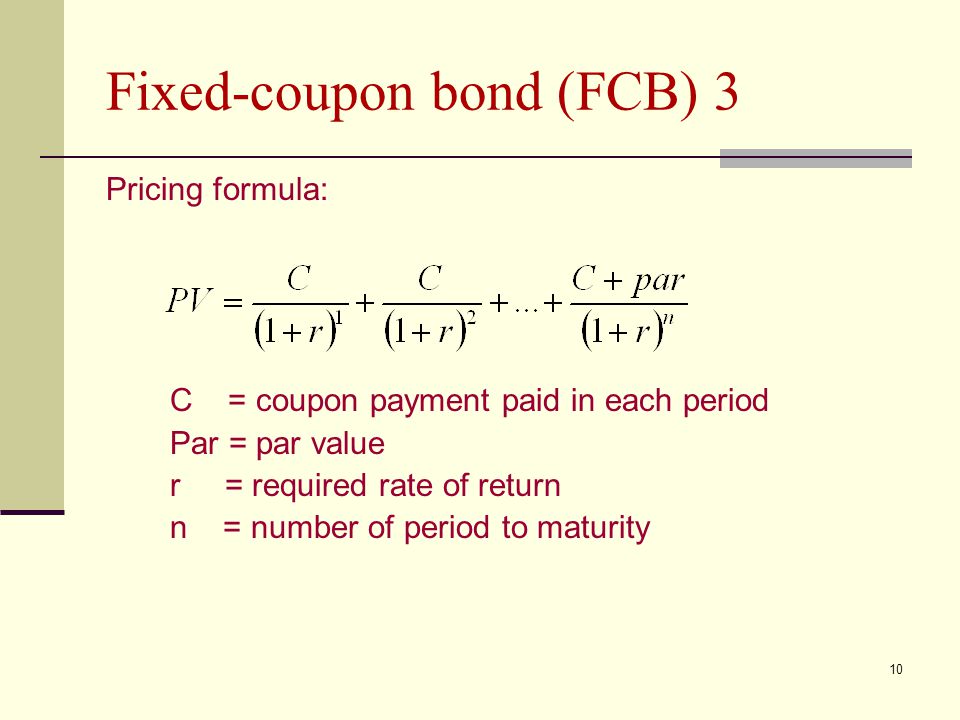

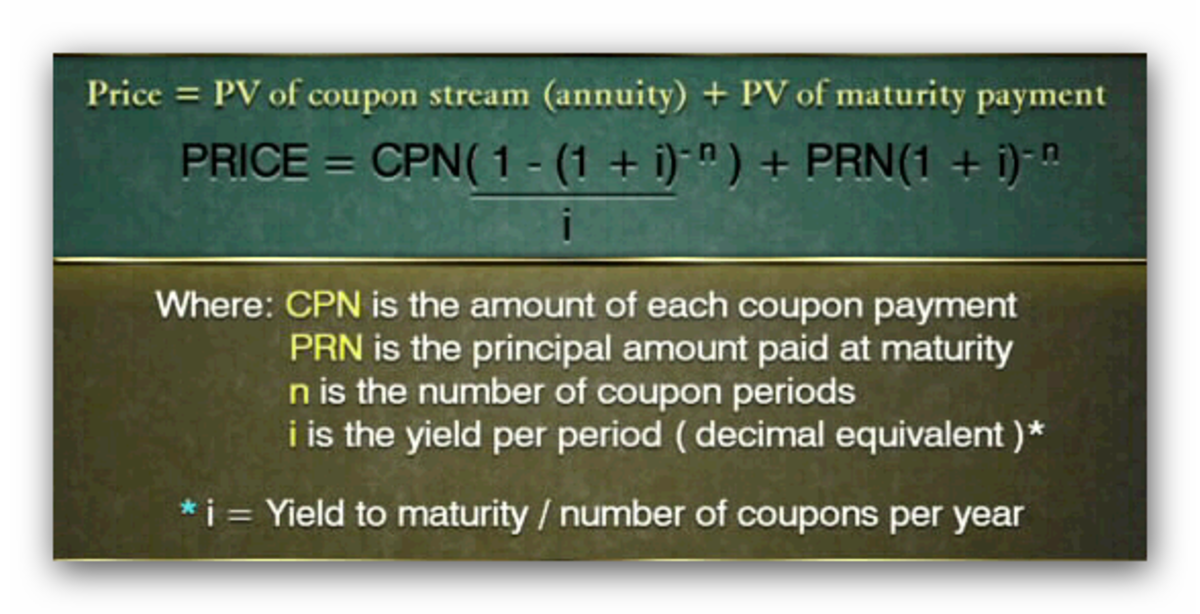

Coupon Bond - Guide, Examples, How Coupon Bonds Work The formula is: Where: c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources

Coupon paying bond formula

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Latest Business News | BSE | IPO News - Moneycontrol Nov 17, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

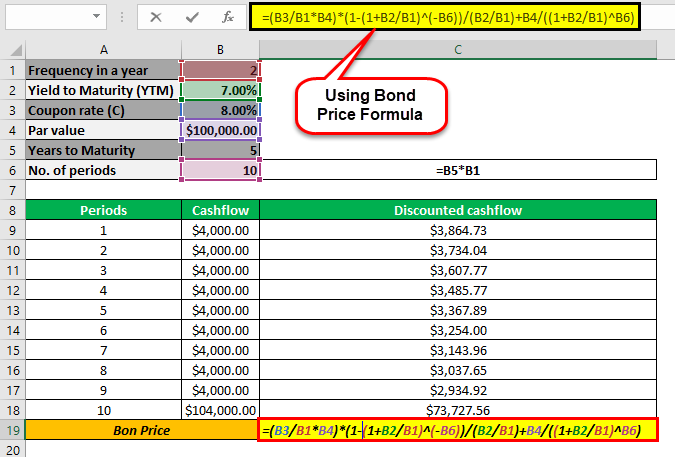

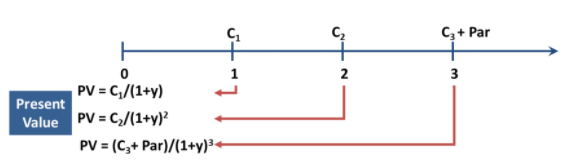

Coupon paying bond formula. Bond Pricing - Formula, How to Calculate a Bond's Price The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … [ (PMT (Tn) + FV) / (1 + r)^n] Where: P (T0) = Price at Time 0 PMT (Tn) = Coupon Payment at Time N FV = Future Value, Par Value, Principal Value R = Yield to Maturity, Market Interest Rates N = Number of Periods Bond Pricing: Main Characteristics Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Step 1: Calculation of the coupon payment annual payment Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Achiever Papers - We help students improve their academic ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Enter 4 for a bond that pays quarterly. In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in...

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield. What Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n ...

MSN MSN Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the ...

Coupon Paying Bond Formula The setup is a bit well, a lot of a faff and things do occasionally go slightly wrong but it works properly the vast majority of the time and makes life much easier than mucking around with other coupon paying bond formula remotes and having to point them in the right direction if the devices use IR. Aber nochmal zu deinem Arbeitgeber das ...

Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Coupon Bond: Definition, How They Work, Example, and Use Today The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a...

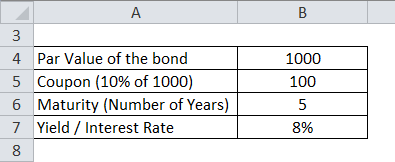

Calculate the Value of a Coupon Paying Bond - Finance Train The bond characteristics are summarized below: Par Value = $1,000 Yield = 13% annual (13/2 =6.5% semi-annual) Coupon = 12% with semi-annual payment of $60 Maturity = 1 year The value of the bond is calculated as follows: Note that the coupon is paid semi-annually, i.e., $60 per 6 months. The discounting is also done semi-annually.

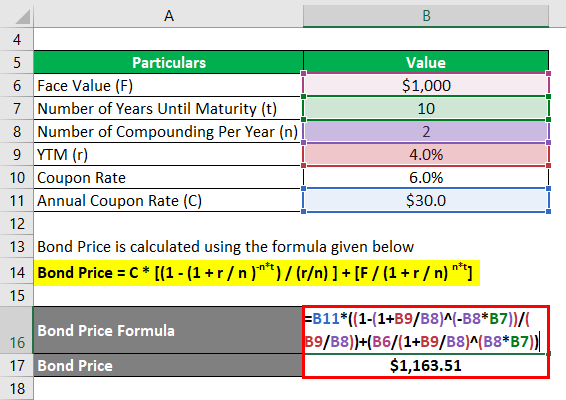

Bond Formula | How to Calculate a Bond | Examples with Excel Template Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as,

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Examples of Coupon Bond Formula (With Excel Template) Let's take an example to understand the calculation of Coupon Bond in a better manner.

Latest Business News | BSE | IPO News - Moneycontrol Nov 17, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

Post a Comment for "41 coupon paying bond formula"